Tesco leads retail charge for 'Amazon tax' to create level playing field

Chains most exposed to physical stores urge Rushi Sunak to claw more in tax from online-only operators.

Monday 8 February 2021 11:45, UK

Tesco and a string of other retailers have united to demand a "level playing field" in the tax system as the coronavirus pandemic wreaks havoc on high street jobs.

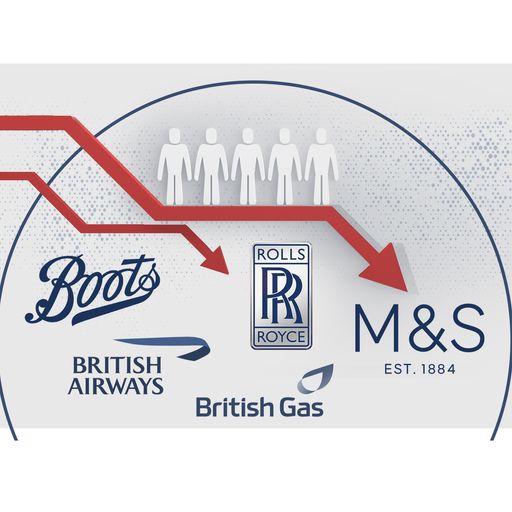

Ahead of the chancellor's budget next month, the letter to Rishi Sunak warned that 15,000 jobs had already been lost this year in the retail sector and there would be "many more to come" without a string of reforms.

The executives and leaders of 18 firms and interest groups, including Asda, Pets at Home and commercial property owner Hammerson, argued online retailers should pay similar levels of tax to brick and mortar firms.

They called for a permanent reduction in business rates as part of the shake-up.

A rates holiday, initiated by the chancellor last year to help retail, hospitality and leisure businesses, is due to expire at the end of March.

But it has seen a string of essential retailers, mostly supermarkets, handing back more than £2bn in rates relief to the Treasury because they have been able to prosper from COVID-19 pandemic disruption to the rest of the high street.

The letter said: "Reducing business rates for retailers and rebalancing the tax system to ensure online retailers pay a fair share of tax would be revenue-neutral, provide a vital boost to bricks and mortar retailers and support communities in need of levelling up."

It falls short of specifically calling for an online sales tax which, the Sunday Times has reported, is being considered as part of a Treasury review of business rates.

Tesco has, separately, renewed its calls for the biggest online players to be hit with a 1% levy.

Investors in online fashion stars Boohoo and ASOS ran for the hills on Monday amid the reports over the weekend, with shares falling by 4.6% and 2.5% respectively.

The largest online seller by revenue, Amazon, last week reported a 51% leap in UK sales during 2020 to £19.4bn as restrictions including lockdowns resulted in a surge in online orders.

The company paid more than £1bn in direct and indirect taxes in 2019 - the last year for which figures are currently available.

A Tesco spokesperson said: "We believe strongly that there should be a level playing field for all retailers, online or physical, which is why we propose a one per cent Online Sales Levy for businesses with annual revenues over £1m, in addition to a 20% reduction in business rates.

"Now is the opportunity to reform business rates and create a system that is fair and sustainable for all."

Waterstones managing director James Daunt, who was among the chief executives to sign the letter to Mr Sunak, said of business rates: "It is starkly evident that they result in the loss of jobs and the degradation of communities most in need of support.

"They are indefensible in their present form, with the immediate consequence of failure to reform the certain loss of tens of thousands of valuable jobs."